Navigating Wealth Management With Confidence

Building, protecting, and growing wealth requires more than sporadic budgeting or reactive decision-making. In today’s dynamic financial environment—shaped by rising interest rates, shifting tax regulations, and volatile global markets—individuals and businesses need a clear, strategic approach to long-term financial planning. Whether managing personal finances or structuring business investments, the right knowledge and guidance can transform uncertainty into opportunity. This article explores essential components of effective wealth management and why expert support can make all the difference.

Understanding the Foundations of Wealth Strategy

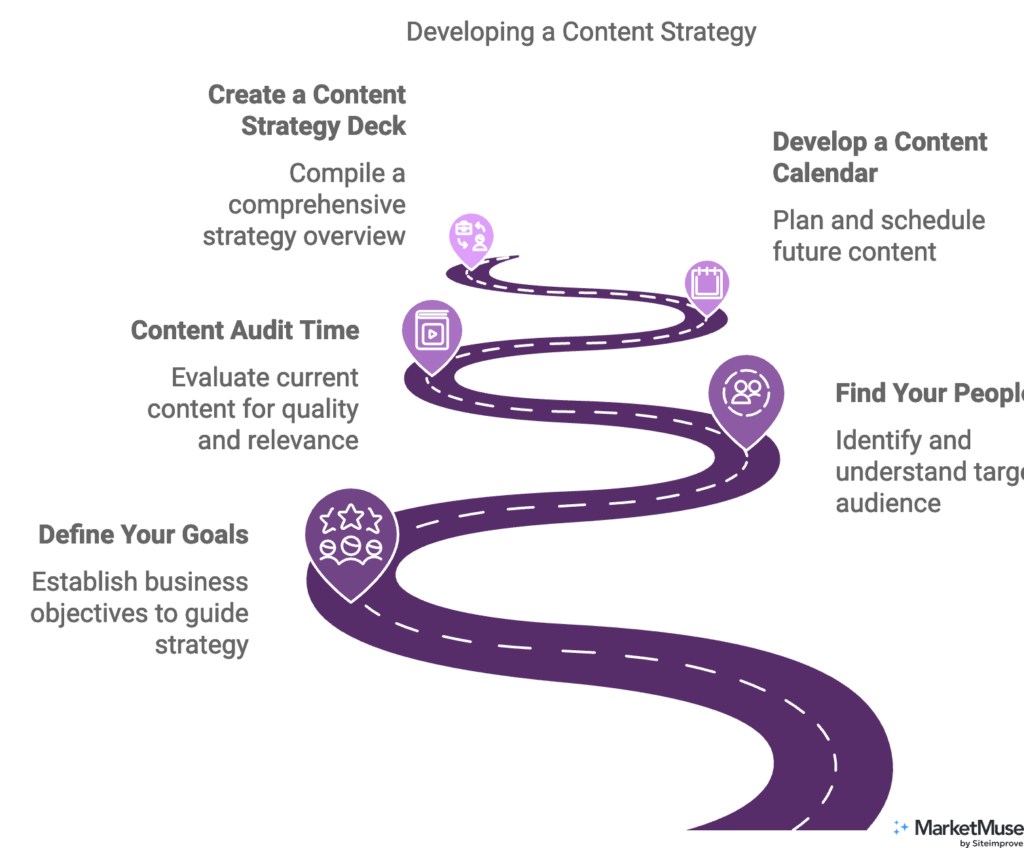

A strong financial strategy begins with understanding your goals. These may include saving for a home, planning for retirement, protecting family assets, or preparing for significant business investments. Each objective requires a tailored approach and a deep understanding of risk tolerance, investment timelines, and expected financial obligations.

Modern wealth management involves more than just investment planning. It incorporates tax efficiency, estate planning, insurance coverage, and ongoing financial reviews. By approaching finances holistically, individuals can reduce exposure to potential risks while maximising long-term gains.

Why Financial Planning Matters More Than Ever

Global events have shown just how quickly economic conditions can shift. Supply chain disruptions, geopolitical tensions, and inflationary pressures can impact everything from household budgets to investment portfolios. A structured financial plan provides stability and direction during uncertain times.

Additionally, tax laws frequently change, making it essential to review and update financial strategies regularly. Keeping an eye on government budgets, fiscal announcements, and market movements helps to ensure that financial plans stay efficient and aligned with evolving rules.

The Role of Professional Guidance

Even with abundant online resources, many people struggle to convert financial information into actionable strategies. This is where qualified professionals can provide exceptional value. They bring extensive market knowledge, regulatory awareness, and personalised planning experience. Their expertise can help individuals avoid common pitfalls, reduce risk exposure, and position themselves for future opportunities.

Professionals can also offer unbiased perspectives. Emotional decision-making—such as panic-selling during market dips—often leads to long-term losses. Expert advisors provide balance, oversight, and strategic thinking, ensuring decisions are made with clarity rather than emotion.

One-Time Keyword Paragraph

For anyone seeking dependable support on their financial journey, many people begin by searching for financial advisors near me to compare expertise, services, and reviews. While local proximity can be helpful, what truly matters is finding a professional who understands your goals, communicates clearly, and prioritises long-term success.

Key Areas of Wealth Management to Consider

A comprehensive wealth strategy typically includes several core elements:

1. Investment Planning

Creating a diversified portfolio that balances risk and return is central to financial success. Investments should align with long-term goals and be reviewed regularly to account for market fluctuations.

2. Retirement Strategy

Pensions, ISAs, and employer contribution schemes all play a role in building retirement income. A well-structured plan ensures stability and financial independence later in life.

3. Tax Efficiency

Understanding available allowances, reliefs, and structures can significantly reduce tax burdens. Efficient planning helps individuals retain more of their earnings and maximise generational wealth.

4. Estate Planning

Wills, trusts, and inheritance strategies ensure assets are protected and passed on according to personal wishes. This area requires expert knowledge due to its legal complexities.

5. Risk Management

Insurance policies, emergency funds, and diversification help reduce vulnerability to unexpected events or financial shocks.

Staying Updated With Market Insights

Wealth management is an evolving landscape. Keeping informed through trusted financial news sources helps individuals understand broader market movements and economic outlooks. Current discussions around interest rates, inflation, and global investment opportunities shape the decisions that individuals and businesses make today.

Two current examples illustrate how rapidly economic factors evolve:

- Recent analyses highlight how central banks continue to adjust monetary policy to stabilise inflation.

- Reports also show an uptick in investor interest in alternative asset classes as traditional markets fluctuate.

Conclusion

Effective wealth management is not a one-time task—it is a continuous process that requires clarity, planning, and adaptability. Whether preparing for long-term security, managing investments, or protecting family assets, the right strategy can deliver lasting peace of mind. With clear guidance and a structured approach, anyone can navigate their financial future with confidence.

Post Comment